Written by Craig Stirling

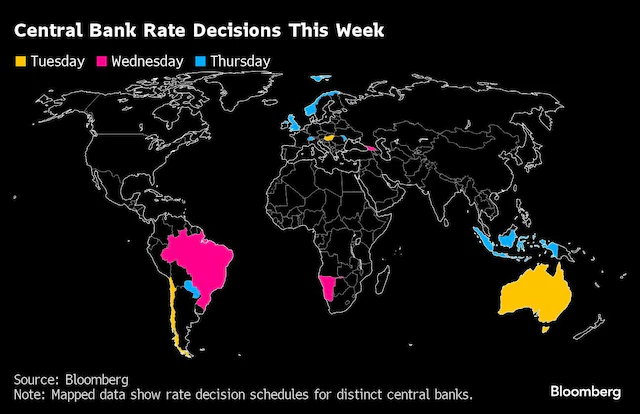

This week’s quartet of choices in advanced economies by central banks, who have been hesitant to join the global interest-rate-cutting cycle, may give them away.

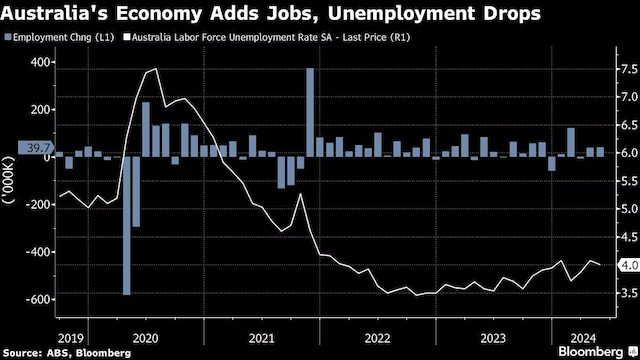

Days after the US Federal Reserve revised down its forecast for this year’s monetary easing, officials from Australia to the UK are expected to indicate that they are still not persuaded enough about disinflation to begin reducing borrowing prices.

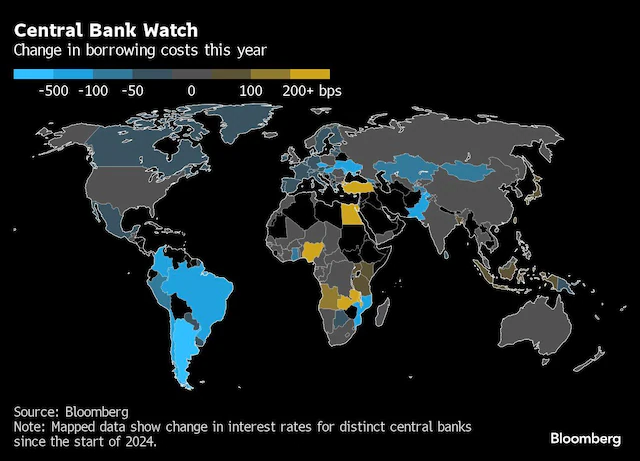

Such results would confirm how June, which was first scheduled to serve as the opening ceremony for a series of rate decreases worldwide, may instead end up serving as a general demonstration of reluctance.

Although Canada was the first country among the Group of Seven to do so on June 5, the European Central Bank’s cut in borrowing costs the following day, coupled with an increase in its forecast for inflation, indicated little appetite for more easing.

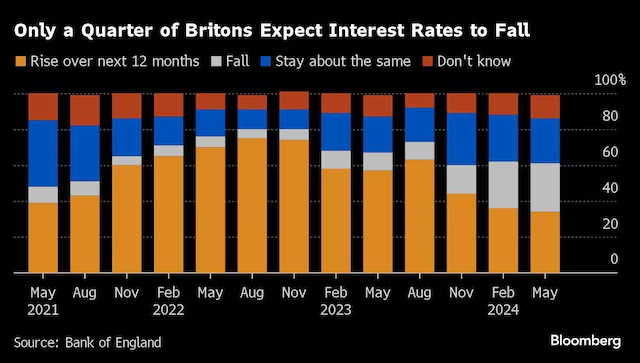

A forthcoming election and some persistent pricing pressures are strengthening the argument at the Bank of England on Thursday to hold off on rate cuts until at least August.

Although peers in Australia and Norway, who are meeting this week as well, are likewise not in a rush to reduce, half of the economists surveyed believe the Swiss National Bank may postpone a second cut for the time being in light of its audacious decision in March to loosen ahead of its neighbours.

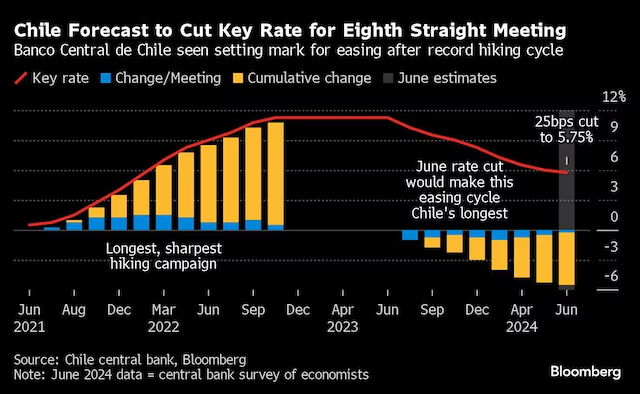

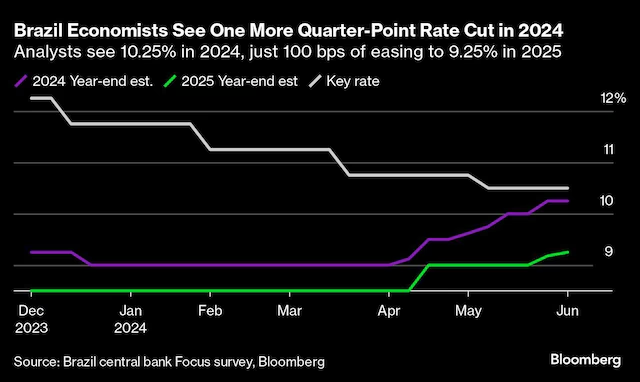

Decisions made in other places could demonstrate the various phases of the global monetary cycles; Chile is predicted to slow rate decreases, while Brazil and Paraguay are predicted to maintain the current level of borrowing costs.

According to Bloomberg Economics:

Major central banks appeared more inclined to decrease interest rates just a few weeks ago, but now they appear certain to maintain them at current levels. Ahead of the UK election in June, the BOE is very likely to maintain its current course of action. The SNB has a closer call.

To view a complete analysis, go here.

This week’s highlights for investors will include US retail sales, a plethora of Chinese data, and inflation figures from the UK and Japan.

For a recap of last week’s events, click here. Below is our outlook for the world economy.

the US and Canada

New data on consumer demand, the housing market, and industrial production will be presented to investors one week after a series of reports indicated a slowing of US inflationary pressures. Additionally, Fed representatives resume public talks after projecting a single rate reduction for 2024.

Thomas Barkin, Susan Collins, Lisa Cook, Mary Daly, Austan Goolsbee, Patrick Harker, Neel Kashkari, Adriana Kugler, Lorie Logan, Alberto Musalem, and John Williams are among the policymakers who will be speaking this week.

Retail sales data released on Tuesday is expected to demonstrate that, following a withdrawal a month earlier, consumers were resilient and that, in May, they somewhat reengaged. There is evidence from several sources that the country’s mines, factories, and utilities are producing more.

Housing starts statistics for May could indicate a little uptick in construction from a month earlier on Thursday as builders continue to monitor inventories and adapt to fluctuations in underlying demand.

Existing house sales are suffering from a shortage of resale listings as well as the recent increase in mortgage rates. The National Association of Realtors is expected to release its data on previously owned house sales on Friday.

Looking ahead, on July 24, the Bank of Canada will publish a summary of the discussions that resulted in its rate reduction this month. This will give additional insight into the decision-making process and the prerequisites for a rate cut.

In addition to releasing population estimates for the first quarter, Statistics Canada will also provide fresh information on the strength of the Canadian consumer through retail sales data.

Asia

Asia’s week begins on Monday with China’s monthly data avalanche. The data probably indicate that while increases in fixed asset investment remained stable at 4.2% and the decline in real estate investment slightly worsened, advances in retail sales and industrial output in May were probably marginally slower than the year-to-date rate.